为客户获得的OFFER选辑

|

嘉 文 博 译 客 户

美 国 / 英 国 商 学 院 录 取 通 知 书 选 辑

(纸质OFFER办公室备查)

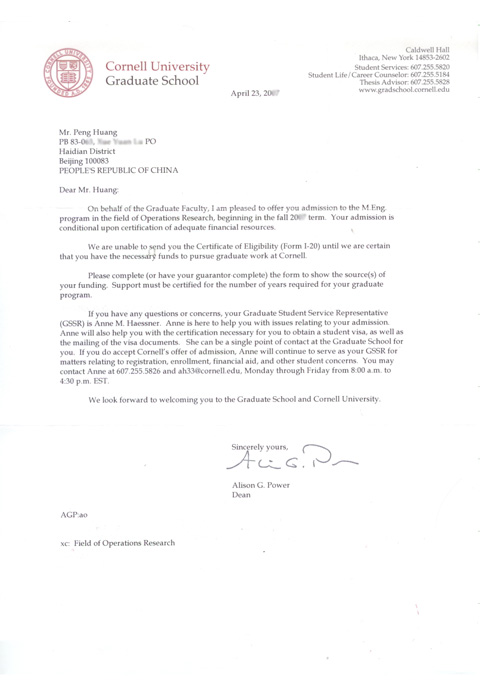

该申请者为北京航空航天大学计算机系学生,拥有本科与硕士学位,毕业后在Bell Labs China (Lucent) 与 Sun Microsystems China Engineering and Research Institute 工作,有很强的数学与计算机背景。申请过程中,利用赴美国出差机会,拜访了所申请的全部金融系的系主任,并进行了深度沟通。最后,获得了当年金融工程排名第四的Cornell大学以及排名第五的Carnegie Mellon大学的录取。其全套申请案例在我们办公室可供备查。

CMU 金融工程信息 / MSCF Program at CUM

Introduced in 1994, Carnegie Mellon's pioneering Master of Science in Computational Finance (MSCF) is considered by many today to be the top quantitative financial engineering program in the country.

The MSCF program is the joint venture of four colleges on our campus - the Tepper School of Business, the Mathematical Sciences Department, the Department of Statistics, and the Heinz College. Administered by the Tepper School of Business, the MSCF student enjoys the advantages of the business school environment, including the full resources of the School's placement services. As a result of the collaborative efforts of these four colleges, MSCF's twenty-five courses are both balanced and deep. Designed expressly for the MSCF student and the needs of the industry, the curriculum seamlessly integrates instruction in probability, statistical analysis, numerical methods, computation and simulation methods, stochastic processes, economics, and their application in today’s quantitative financial markets.

The MSCF program is intense and extremely demanding - recruiters know the students graduating from MSCF are bright, highly motivated and keenly interested in the financial engineering industry. Our employment rates remain high - even in these challenging times.

If your passion is to be in derivative sales and trading, solving client needs through structured products, financial analytics, or risk management, there is no program better able to provide you with the educational tools and recruiting services you need to succeed!

Curriculum

COURSE OF STUDY

Over the fall and spring semester of the first year, students are taught traditional finance theories of equity and bond portfolio management, the stochastic calculus models on which derivative trading is based, computational methods including Monte Carlo simulation and finite difference approximations of partial differential equations, and statistical methodologies including regression and time series. Also provided is a "Presentations" course which provides one-on-one assistance in helping students better communicate their ideas before their peers, and the Deutsche Trading Competition which uses CMU's FAST software to emulate a trading environment with cash prizes awarded to the top traders at a special reception at Deutsche Bank. During the semester following the summer internship, students take courses in asset pricing, statistical arbitrage, risk management and dynamic asset management. The program concludes with a sophisticated financial computing course, an algorithmic trading competition, and a case-based presentation course in financial engineering. In addition to VBA, Matlab and S+ packages, C++ is incorporated into the curriculum and students create software in several courses.

EXCLUSIVELY FOR MSCF

Each of our twenty-five courses has been designed expressly for the MSCF program. For example, "Stochastic Calculus for Finance," taught by the Math Department, is not the stochastic calculus course offered to students in the Math Department, but rather a course that develops stochastic calculus within the context of models drawn from the financial services industry. "Credit Derivatives," “Statistical Arbitrage”, “Simulation Methods of Options Pricing,” “Linear Financial Models” - every one of our courses has been similarly designed.

MSCF ADVISORY BOARD

We keep abreast of changes in the financial marketplace from our frequent contact with our recruiters, our alums, our professors as a result of their various research and consulting engagements, with market practitioners through the MSCF Speaker Series, and our periodic meetings with the MSCF Advisory Board. The MSCF Board is comprised of senior executives from the financial services industry (see column on right).

CENTER FOR COMPUTATIONAL FINANCE

Research in quantitative finance at Carnegie Mellon is a campus-wide activity. This is fostered in part by the Center for Computational Finance housed in the Department of Mathematical Sciences. The research of Carnegie Mellon faculty affiliated with the Center brings them in contact with industry practitioners and facilitates updating the MSCF curriculum with the latest knowledge in quantitative finance.

How to Apply

MSCF is a sophisticated, rigorous course of instruction. Outstanding academic credentials are necessary for admission to the program. Applicants should hold an undergraduate degree in a technical discipline such as mathematics, computer science, engineering or economics. Successful applicants will have taken at least two full semesters of study in differential and integral calculus, the caliber of which is required of engineering, math or science majors (ordinary differential equations, linear algebra, and a calculus based probability course). Applicants should have strong academic performance in mathematics and probability coursework.

Applicants must be fluent in a general purpose programming language such as C. Familiarity with C++ will be of considerable benefit. Applicants lacking these skills may still be considered, provided they take steps to acquire the necessary skills before entering the program and satisfy the admissions committee requirements.

Relevant professional experience is preferred but not required. If you are accepted for admission to Carnegie Mellon's MSCF program and have not completed all of your undergraduate work at the time the application was made, you must, before registration, submit the completed academic records and certification that your undergraduate degree has been awarded.International applicants must understand rapid, idiomatic English, read English with ease and be able to express themselves orally and in writing as demonstrated by success on the TOEFL or IELTS examination.

All full-time degree candidates admitted to the MSCF program will be automatically considered for an "MSCF Merit Scholarship". No additional application is required to be reviewed for this award. Criteria for a merit scholarship is based on the strength of a student's overall candidacy relative to the application pool for the year. All merit scholarships are partial scholarship awards. Visit the Tuition and Financial Aid section of our website for more information on scholarship and other financing options.

All MSCF degree students are required to have a laptop computer available for use for the duration of the MSCF program. A fully supported, laptop computer, pre-loaded with the software needed for the MSCF program and configured for either wireless or Ethernet access to the internet and CMU networks, is available for purchase through the MSCF program.

北京市海淀区上地三街9号金隅嘉华大厦A座808B 电话:(010)-62968808 / (010)-13910795348 钱老师咨询邮箱:qian@proftrans.com 24小时工作热线:13910795348 版权所有 北京嘉文博译教育科技有限责任公司 嘉文博译翻译分公司 备案序号:京ICP备05038804号 |